Business cost support (3rd round)

Third application round of business cost support 27 April-23 June.

Click here to go to the home page.

Click here to go to the home page.

For the common good and customers’ best.

Third application round of business cost support 27 April-23 June.

The third application round for cost support started on 27 April at 9:00.

The application period ended on 23 June at 4.15 pm. The support period is from 1 November 2020 to 28 February 2021. The support can be applied through the State Treasury’s e-service. On this page, you will find instructions for applying for support

Website for second cost support application round >

The processing time for claims for a revised decision is currently about 5-6 months. If we need more information to process your claim, our customer service representatives will contact you. We process all claims for a revised decision on a first come, first served basis, and unfortunately it is not possible to expedite the processing by contacting the State Treasury.

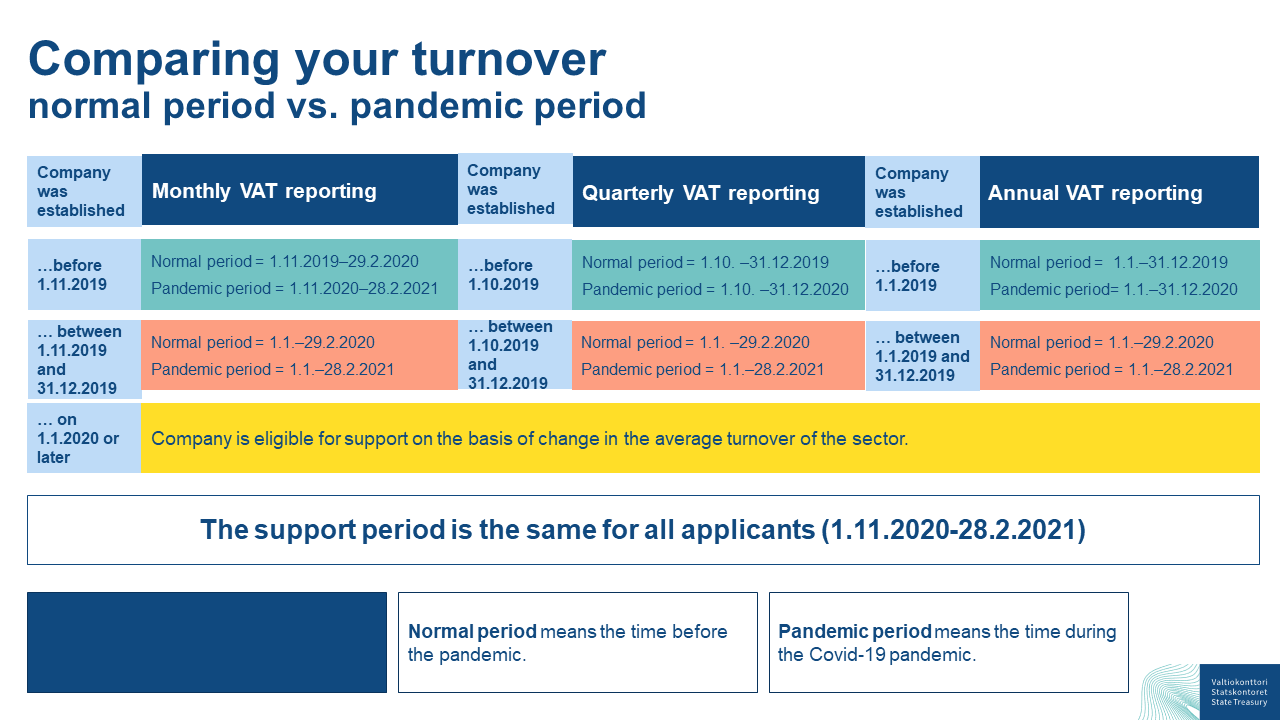

The application period for the fourth round of cost support begins on 17 August and support can be applied for from March to May. The third application round for cost support will take place from 27 April to 23 June 2021. The support period is 1 November 2020-28 February 2021. The reference period depends on the company’s VAT declaration period and the date of establishment of the company.

The support is intended for companies whose turnover has fallen significantly as a result of the COVID-19 pandemic and whose wages and other costs for the support period (1 November 2020 to 28 February 2021) are difficult to adjust. The aim of the cost support is to support businesses in the difficult situation caused by the COVID-19 pandemic and to reduce the number of companies going bankrupt by giving companies more time to adjust their activities and costs once the COVID-19 crisis persists.

In the third round of cost support, changes have been made to the support to allow for more flexible support, especially for sole proprietors and small businesses. Sole proprietors and small businesses have been able to apply for cost support in the past, but a large proportion of the cost support applications for the smallest companies have been rejected. The main reason for rejecting the aid application has been that the aid is below the threshold of EUR 2000.

The aid is granted on the basis of the decline in companies’ turnover and actual costs. In future, the aid will be paid at least EUR 2000, even if the company’s aid is calculated to be less than that amount. In this way, more small businesses and sole proprietors can receive support if other support conditions are met.

A company can apply for cost support if it has a business ID. It is also required that the company has eligible costs of at least EUR 2000 during the aid period and that its turnover has decreased by more than 30% compared to the reference period.

The third application round for cost support starts on 27 April at 9:00 and ends on 23 June.

The support can be applied for via the State Treasury’s e-services. The e-service guides you in filling in the application. You can also save the application as a draft and continue filling it out later.

You can use the application form to provide all the information needed. In addition, the State Treasury automatically receives information from other authorities, such as the Tax Administration and the Income Register, in order to grant support.

You will receive a case number and a notification in your email upon successful registration. You do not need to contact the State Treasury before or after sending in the application. The State Treasury will request additional information if necessary.

Inquiries do not speed up the processing of the application. The estimated processing time will be updated on the State Treasury’s website.

Apply for cost support if

In addition to the company’s own turnover, the decline in the turnover of the company’s sector is estimated. If the sector’s turnover has fallen by at least 10% during the support period, the company can apply for cost support without further justification, provided that the other conditions of the support are met.

Even if the company’s main sector is not eligible under the Government Decree, cost support may be granted to it on discretionary grounds.

In addition to companies, foundations and associations can also apply for support.

In addition to companies, associations and foundations can apply for cost support. Cost support can only be granted for the financial activities of associations and foundations.

The support is granted under the EU Temporary COVID-19 Framework Program for Support (Commission Decision SA.56995). All aid granted under this framework is subject to a company specific cap of EUR 1,800 000, which may not be exceeded when the support is granted. When calculating the maximum amount of EUR 1,800 000, all support received by an individual company and of companies belonging to the same group as the one receiving grant under this frame shall be taken into account.

In the third application round for business cost support, companies that fall within the specific sectors defined by the Government Decree, and that were established on or after 1 January 2020, are eligible for support on the basis of changes in the average turnover of the sector. However, such companies are not eligible for discretionary support because they cannot demonstrate a change in their turnover.

The minimum amount of support is EUR 2,000. The maximum amount of aid is EUR 1 million, which meets the needs of large companies in particular. The maximum amount of support was EUR 500,000 in the previous application rounds.

The aid already granted will be taken into account in the amount of the business cost support so that the total aid granted under the same temporary State aid rules of the European Commission will not exceed EUR 1.8 million. The maximum amount of total aid was previously EUR 800,000. The new maximum amount is based on the Commission’s decision to raise the company-specific ceilings for aid.

The amount of the cost support and closure compensation depends on the other costs during the support period as reported by the company on the application. According to the Act on Cost Support, other costs during the support period refer to the inflexible operating costs and losses during the support period (1 November 2020 to 28 February 2021) justified by the company that are final and for which no cost support has previously been granted. The company must be able to distinguish the costs during the support period from other expenses it has declared on the application.

Inflexible costs cannot be adjusted in a way that corresponds with the volume of activities. In other words, even if the company does not have any sales, these expenses must be paid and it is not possible to adjust them according to decreased business activities unlike, for example, material and supplies costs or new investments.

The content of the inflexible costs that the amount of cost support is based on may be different for each company. Such costs include, but are not limited to, rental costs and other expenses concerning property used for business, equipment and item rentals, compensation for the right of access, licence fees, and necessary hired labour costs. Losses may include, for example, prepayments made by the company that have proved to be final.

The company must notify the State Treasury if the inflexible costs or losses indicated in the application later change, for example in the form of discounts received by the company or reductions in expenditure.

Below, you can find examples of expense types that can be considered inflexible costs and losses during the support period as referred to in the Act. Please note that the list is not exhaustive but only includes some examples. The eligibility of declared costs and losses is always decided on a company-specific basis when granting cost support.

Rental and other expenses on property used for business:

• Rental expenses related to the company’s property/premises (such as facility and property rent)

• Maintenance charge

• Electricity, water, gas, steam

• Security, facility surveillance or security systems

• Inflexible cleaning costs, waste management

• Property insurance premiums and property tax

• Statutory vehicle insurance premiums and taxes

• Road maintenance fees

• Interest expenses on a loan related to real estate

• Inflexible financial, accounting and audit costs

• Inflexible communications technology and phone plan expenses

• Maintenance costs for animals used in business

• Rental and bank guarantee costs

Equipment and item rentals

• Cost of leased vehicles

• Leased electronics (computers, monitors, phones, etc.)

License and access right fees

• Inflexible franchising fees

• Inflexible taxi hire company fees

• Royalty payments

• Computer software license fees

• Inflexible server costs (purchased from an external service provider)

Necessary hired labour cost

Necessary hired labour cost are considered to be e.g. hired labour costs that correspond to activities by the company’s own staff that are necessary for maintaining business or business readiness. Only necessary hired labour cost labour costs are eligible for the cost support. Upon request, the company must present a report on the necessity of using hired labour to maintain the company’s business.

Inflexible losses

Inflexible losses may include, for example, prepayments made by the company that have proved to be final. This may include advance payments made by a tour company to hotels or service providers for which the company has not received any refunds despite the cancellation of the trip. Upon request, the company must be able to verify that the losses indicated in the application are final and cannot be reasonably refunded by the receivers of the prepayments or other parties.

Payroll costs include the direct wages the company has paid. The State Treasury will collect this information from the income register. In addition, the employer’s non-wage labour costs would be accepted as payroll costs, calculated as a percentage of the payroll costs. Non-wage labour costs include sick pay, holiday pay and holiday bonus, as well as social security contributions and occupational health expenses.

For private traders and general partners of a partnership, the earned income reported to self-employed persons’ pension insurance would be accepted as payroll costs. The contributions to the self-employed persons’ pension insurance and to health insurance would also be accepted as payroll costs based on the company’s declaration.

Reference periods refer to the periods for which the comparison defines the decrease in the company’s turnover between the normal period and the pandemic period. The granting of cost support is subject to a drop in turnover of more than 30%.

The normal period and the pandemic period are determined by the company’s VAT reporting period and the date of establishment. You can use the counter on the counter tab to find out your reference period.

The support period, for which cost support is applied for, is the same for all applicants.

According to the bill, support will not be granted in the following situations

Definition of a company in difficulty in the EU Regulation:

A company in difficulty refers to a company in accordance with Article 2(18) of the General Block Exemption Regulation of the EU. According to the definition, a company is in difficulty,

a. if more than half of its share capital has disappeared as a result of accumulated losses (limited liability companies),

b. more than half of its capital as shown in the company accounts has disappeared as a result of accumulated losses (companies where at least some members have unlimited liability for the debt of the company),

c. the company is subject to collective insolvency proceedings,

d. the company has received rescue aid and has not yet reimbursed the loan or terminated the guarantee, or has received restructuring aid and is still subject to a restructuring plan,

e. the company is not an SME, and for the past two years, its book debt to equity ratio has been greater than 7.5 and its EBITDA interest coverage ratio has been below 1.0.

Only section c applies to SMEs that were under 3 years of age on 31 December 2019.

Cost support and closure compensation can be applied for even if the company has already received other direct subsidies intended to alleviate the consequences of the COVID-19 pandemic. However, the support already granted is taken into account in determining the amount of the cost support, and the total amount of support may not exceed EUR 1,00,0000. The maximum amount of support per company is laid down in the European Commission’s regulations on temporary State aid.

A company may also authorise another individual to represent the company via the Suomi.fi e-Authorizations service. Select the mandate ‘Application for corporate financing’.

The customer service of the Digital and Population Data Services Agency is available to assist companies in the use of Suomi.fi mandates.

You can contact us on: +358 295 53 5115

Note. Representative of the association or foundation: if you have any problems with Suomi.fi authorization, please contact the cost support customer service kustannustuki@valtiokonttori.fi

The chairman of the association, who is entered as a chairman in the Finnish Register of Associations, may fill in the application for Cost Support on behalf of the association in e-service. In addition to the application, an association must send evidence via a supplementary information notice that the chairman has the right to sign for association alone or is authorized by the signatories to send the application (association register / rules / minutes / power of attorney).

In the case of foundations, the application should be sent as a paper application if the authorization rights are not already defined.

In the application, you must fill in the company’s basic data, pandemic and normal period turnover data, if they are not available directly from the Tax Administration on the basis of the company’s VAT returns; information on losses (type and amount of expenditure, eg rent); and information on insurance claims related to COVID-19 pandemic, if they compensate for damage during the support period, and information on support under the EU Framework. Sole trader also needs to provide information on YEL income, YEL pension contribution and health insurance.

The State Treasury receives some of the necessary information from the Tax Administration, the Income Register, Statistics Finland and other authorities that have granted state aid.

The State Treasury strives to make applying as effortless as possible. The application has been tested with a client jury and has received good feedback.

If you are dissatisfied with the decision you have received, you can request a rectification from the State Treasury. Processing a claim for rectification at the State Treasury is free of charge.

Before submitting a claim for rectification

How is the claim for rectification made?

What information should be contained in the claim for rectification?

When do I have to make a claim for rectification?

Processing of the claim for rectification

Appeal to the Administrative Court

If you have any questions regarding applying for cost support, you can receive help and advice from your region’s local business counsellor. The service is free and confidential.

Below, you can see a list of business counselors with whom the State Treasury cooperates.

Call us+358 295 50 3050, Mon–Fri from 9 a.m. to 15

Send email

Additional informationThe State Treasury does not charge for calls made to numbers starting with the sequence 0295. Operators will charge standard mobile / local network rates for these calls.

The business cost support counter allows you to estimate the amount of cost support that your business can be granted to. The cost support is granted to businesses that fulfil the conditions laid down in the Act on fixed-term cost support for business costs (508/2020). If the company’s industry is not within the support scope, the company may be granted support at discretion.

Please note that the calculator is only indicative as it does not include all the conditions mentioned in the Act. Please also note that the sum indicated by the calculator is not a formal decision on cost support but a separate application for support must be submitted through the e-services.

Note! Companies that fall within the specific sectors defined by the Government Decree, and that were established on or after 1 January 2020, would be eligible for aid on the basis of changes in the average turnover of the sector. However, such companies would not be eligible for discretionary aid because they cannot demonstrate a change in their turnover. Therefore, those companies are not able to use the calculator to estimate the amount of support.

Cost support is based on a change in turnover. Turnover means sales excluding VAT.

The business can be granted the support if its average turnover has fallen by more than 30%, its main sector of business is within the scope of support, or the business provides serious arguments on why the coronavirus pandemic has affected the decline in turnover. Please see the detailed terms and conditions for the payment of support here.

According to law, minimum amount of cost support is EUR 2,000. The maximum amount of cost support that can be granted is EUR 1,000,000 per company.

The maximum amount of State support under the EU framework support programme related to the corona pandemic is € 1,800,000 per company or corporate group if the company is part of a group. The State Treasury must ensure that the amount is not exceeded.

Reference period (A) EUR 50,000

Support period (B) EUR 5,000

Decrease in turnover 90 %; is calculated as follows: (A-B)/A x 100%

minus a fixed-sum excess of 30 % -> the percentage of support in the example is 60 %

Fixed costs EUR 10,000

Salaries EUR 12,000

Total EUR 22,000

Support before the deduction of insurance payments: EUR 13,200; calculated as follows: 22,000 x 60%

Insurance payments EUR 1,000

Amount of support to be paid EUR 12,200

Therefore: (EUR 10,000 + EUR 12,000) x 60% – insurance payments = EUR 12,200

Reference periods refer to the periods for which the comparison defines the decrease in the company’s turnover between the normal period and the pandemic period. (The granting of cost support is subject to a drop in turnover of more than 30%).

The normal period and the pandemic period are determined by the company’s VAT reporting period and the date of establishment. When you select your company’s reference period and the date of establishment in the help table, they are shown in the calculator next to respective fields.

Note. The support period, for which cost support is applied for, is the same for all applicants (1.11.2020-28.2.2021).

According to law, minimum amount of cost support is EUR 2,000. The maximum amount of cost support that can be granted is EUR 1,000,000 per company.

The State Treasury does not charge for calls made to numbers starting with the sequence 0295. Operators will charge standard mobile / local network rates for these calls.

Exchange: +358 295 50 2000

Note! You can change the language from the upper right corner of the secure mail site.

Notifications