Business cost support (2nd round)

Third round of the support is under preparation. Read more on the ministery of economic affairs and employment website.

Click here to go to the home page.

Click here to go to the home page.

For the common good and customers’ best.

Third round of the support is under preparation. Read more on the ministery of economic affairs and employment website.

This is the service page for fixed-term support for business costs. The page consists of three sections. The General information about support tab contains basic information about the service, the Guidelines for applying for support tab provides more detailed information on how to apply for support, and the Application for support & legislation tab allows you to log in to the service channel once the round of application has begun. The counter allows you to estimate the amount of cost support that your business can be granted to.

The second application round for cost support has ended on February 26, 2021 at 4.15 pm.

Applications’ processing time varies between a few days and a month. You can check the status of your application on the statistics page, where you can see all pending applications. We will contact you if we need more information and you will be notified of the decision by email or letter.

Currently the processing time for correction claims is about 3-4 months.

Business cost support is intended for companies whose turnover has fallen due to the coronavirus pandemic and therefore have difficulties in dealing with the salary expenses and other expenses for the period for which the support is available. According to the Government’s policy, the need for size of the support is assessed on the basis of the sudden loss of turnover caused by the epidemic and the preventative measures imposed.

The first round of applications for cost support was open until 31 August 2020. In its negotiations of 29 September 2020, the Government decided that companies of all sectors should once again receive the opportunity to apply for cost support, as the situation caused by the coronavirus pandemic will continue to be difficult for a number of sectors in autumn 2020. The State Treasury will start the processing of applications on 21 December 2020.

The cost support is intended for companies whose turnover has fallen significantly due to the coronavirus pandemic and are therefore having difficulties in coping with salary expenses and other inflexible business expenses.

The size or type of the company is not limited, the decisive factor is the economic composition of the operation.

Foundations and associations doing business may also receive cost support. Cost support is provided only for the financial activities of the association/foundation.

Amendments have been proposed to make the cost support better meet the needs of the most affected companies. However, the basic principles for the support remain unchanged. During the second round of application, the support will be directed towards operational businesses, and the expenses they face difficulties in covering, by expanding and further specifying the expenses that can be covered and by extending the period of support. The goal of this is to support companies facing a variety of different situations to adapt their operations in a future-orientated manner.

The aid is retroactive in nature, ie. it is paid for costs already incurred.

Applying on a discretionary basis

Companies outside the scope of the sectors can also apply for support, as support can be granted on a discretionary basis to those companies that meet the other conditions for granting support laid down by law. The State Treasury hopes that all eligible companies will receive support. Therefore we recommend that you indeed apply for cost support on a discretionary basis outside the sector boundary in case the other criteria is met.

However, no cost support may be granted to the sectors of primary agricultural production, fisheries and aquaculture. These sectors cannot be supported, not even on a discretionary basis, as they are subject to separate state aid rules under the responsibility of the Ministry of Agriculture and Forestry.

The second application round for cost support has ended on February 26, 2021 at 4.15 pm.

The temporary Cost Support is intended for companies that meet the following conditions:

• The company’s sector is covered by the support (the list of sectors) OR a company whose main activity is not mentioned in the Government decree, but which is able to show particularly serious reasons caused by corona pandemic.

• The company’s own turnover for the support period has decreased by more than 30% compared to the comparison period.

• The company has salary costs and / or inflexible costs and losses during the support period (1 June 2020 -31 October 2020), which are difficult to adjust. The costs must be final.

• The amount of Cost Support for the company is at least 2000 euros.

• The company is not subject to any obstacle to being granted cost support within the meaning of the Cost Support Act.

In addition to companies, associations and foundations can apply for cost support. Cost support can only be granted for the financial activities of associations and foundations.

The support is granted under the EU Temporary COVID-19 Framework Program for Support (Commission Decision SA.56995). All aid granted under this framework is subject to a company specific cap of EUR 800 000, which may not be exceeded when the support is granted. When calculating the maximum amount of EUR 800 000, all support received by an individual company and of companies belonging to the same group as the one receiving grant under this frame shall be taken into account.

The support can be applied for via the State Treasury’s e-services. Please begin by reading the application instructions published on the Application instructions tab.

Receiving cost support is based on the act and the related decree. The bill was drafted by the Ministry of Economic Affairs and Employment and the Ministry of Finance, and the law came into effect on the 15st of December 2020.

The comparison period for turnover is 1 June 2019 – 31 October 2019. If the company was founded on 1 May 2019 or later, the comparison period is 1 January 2020 – 29 February 2020. The support period for all companies is 1 June 2020 – 31 October 2020.

The amount of the decrease in the company’s turnover is determined by comparing the average monthly turnover of the comparison period and the support period. The amount of the decrease in turnover affects the amount of Cost Support granted to the company. The decrease in turnover must be more than 30% in order for a company to be eligible for cost support. See also How much support you can get.

The decrease in turnover is stated in the VAT declarations submitted to the Tax Administration or, in the absence of these, in the turnover data according to the company’s own declaration.

According to the act, the support granted to the company must exceed €2,000. The maximum amount of support is €500,000 per company.

The support is based on information on the company’s turnover during the comparison period and the turnover during the support period; inflexible costs and losses; and wage costs reported by the company for the support period. The turnover data from the support period and comparison period are primarily obtained from the data provided by the Tax Administration to the State Treasury. The State Treasury receives the salary costs of the company during the support period directly from the Income Register. Salary costs of a sole proprietor and partners of public limited companies as well as limited partnerships, which do not appear in the income register, can be declared separately by the company in the application.

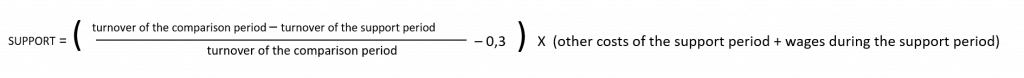

The amount of Cost Support for the support period is calculated using a statutory calculation formula. The company’s turnover for the support period is compared to the company’s turnover for the comparison period. From the decrease in turnover shown in the calculation, the company’s deductible is first deducted as 0.3, which corresponds to a decrease in turnover by 30 per cent. The figure obtained multiplies the inflexible costs and losses of the support period reported by the company and the wage costs of the support period. When granting cost support, other costs and salary costs for the support period are taken into account on a monthly basis, up to a total amount corresponding to the average monthly turnover of the company in the comparison period.

The insurance claims received by the company in connection with the COVID-19 pandemic are deducted from the amount shown in the calculation.

Explanations of the formula:

Turnover of the comparison period = Average sales of the company in June-October 2019. If the company was founded on or after May 1st 2019, the sales for the comparison period are the average sales of January-February 2020.

Turnover of the support period = Average sales of the company in June-October 2020.

Other costs during the support period = Inflexible operating costs and losses duly justified by the company during the support period, which are definitive and for which no Cost Support has previously been granted.

Wages during the support period = the amount of wages paid by the company during the support period according to the information obtained from the Income Register. The salary costs of sole proprietor entrepreneurs and the salary expenses of the partners of public limited companies and limited partnerships, which do not appear in the Income Register, can be declared separately by the company in the application. In the case of temporary employment enterprises, only the wage costs of the employees working for the enterprise itself are taken into account as wage costs.

0.3 = Sales deductible 30%.

The amount of the cost support depends on the other costs during the support period as reported by the company on the application. According to the Act on Cost Support, other costs during the support period refer to the inflexible operating costs and losses during the support period (1 June to 31 October 2020) justified by the company that are final and for which no cost support has previously been granted. The company must be able to distinguish the costs during the support period from other expenses it has declared on the application.

Inflexible costs cannot be adjusted in a way that corresponds with the volume of activities. In other words, even if the company does not have any sales, these expenses must be paid and it is not possible to adjust them according to decreased business activities unlike, for example, material and supplies costs or new investments.

The content of the inflexible costs that the amount of cost support is based on may be different for each company. Such costs include, but are not limited to, rental costs and other expenses concerning property used for business, equipment and item rentals, compensation for the right of access, licence fees, and necessary hired labour costs. Losses may include, for example, prepayments made by the company that have proved to be final.

The company must notify the State Treasury if the inflexible costs or losses indicated in the application later change, for example in the form of discounts received by the company or reductions in expenditure.

Below, you can find examples of expense types that can be considered inflexible costs and losses during the support period as referred to in the Act. Please note that the list is not exhaustive but only includes some examples. The eligibility of declared costs and losses is always decided on a company-specific basis when granting cost support.

Rental and other expenses on property used for business:

• Rental expenses related to the company’s property/premises (such as facility and property rent)

• Maintenance charge

• Electricity, water, gas, steam

• Security, facility surveillance or security systems

• Inflexible cleaning costs, waste management

• Property insurance premiums and property tax

• Statutory vehicle insurance premiums and taxes

• Road maintenance fees

• Interest expenses on a loan related to real estate

• Inflexible financial, accounting and audit costs

• Inflexible communications technology and phone plan expenses

• Maintenance costs for animals used in business

• Rental and bank guarantee costs

Equipment and item rentals

• Cost of leased vehicles

• Leased electronics (computers, monitors, phones, etc.)

License and access right fees

• Inflexible franchising fees

• Inflexible taxi hire company fees

• Royalty payments

• Computer software license fees

• Inflexible server costs (purchased from an external service provider)

Necessary hired labour cost

Necessary hired labour cost are considered to be e.g. hired labour costs that correspond to activities by the company’s own staff that are necessary for maintaining business or business readiness. Only necessary hired labour cost labour costs are eligible for the cost support. Upon request, the company must present a report on the necessity of using hired labour to maintain the company’s business.

Inflexible losses

Inflexible losses may include, for example, prepayments made by the company that have proved to be final. This may include advance payments made by a tour company to hotels or service providers for which the company has not received any refunds despite the cancellation of the trip. Upon request, the company must be able to verify that the losses indicated in the application are final and cannot be reasonably refunded by the receivers of the prepayments or other parties.

Examples of types of costs which cannot in principle be considered as eligible inflexible costs or losses:

• Depreciation and amortisation

• Statutory pension insurance for self-employed people and earnings-related pension payments

• Health care

• Write-downs

• Loan repayments and capital expenditure charge

• Instalments

• Non-recurring costs

• Fuel (material and supplies expenses)

• Membership payments

• Credit loss

• Bank charges

• Management costs for loans guaranteed by Finnvera

• Marketing costs

According to the bill, cost support can be applied for even if the company has already received other direct subsidies intended to alleviate the consequences of the coronavirus pandemic. However, the support already granted is taken into account in determining the amount of the cost support, and the total amount of support may not exceed EUR 800,000. The maximum amount of support per company is laid down in the European Commission’s regulations on temporary State aid.

According to the bill, support will not be granted in the following situations:

2. The turnover of the company during the support period has not decreased by more than 30% compared to the turnover of the comparison period.

3. The company’s main line of business is not covered by the support and the company has no COVID-19-related particularly serious reasons for the decrease in turnover.

4. The company is not registered in the prepayment register.

5. The company has failed to file a tax return.

6. The company has tax debt information in the tax debt register.

7. Recovery proceedings has collected unpaid taxes from the company.

8. The company has been declared bankrupt or is the subject of bankruptcy proceedings.

9. The company was in difficulty before the coronavirus pandemic (31 December 2019). See the definition of a company in difficulty.

Definition of a company in difficulty in the EU Regulation:

A company in difficulty refers to a company in accordance with Article 2(18) of the General Block Exemption Regulation of the EU. According to the definition, a company is in difficulty,

a. if more than half of its share capital has disappeared as a result of accumulated losses (limited liability companies),

b. more than half of its capital as shown in the company accounts has disappeared as a result of accumulated losses (companies where at least some members have unlimited liability for the debt of the company),

c. the company is subject to collective insolvency proceedings,

d. the company has received rescue aid and has not yet reimbursed the loan or terminated the guarantee, or has received restructuring aid and is still subject to a restructuring plan,

e. the company is not an SME, and for the past two years, its book debt to equity ratio has been greater than 7.5 and its EBITDA interest coverage ratio has been below 1.0.

Only section c applies to SMEs that were under 3 years of age on 31 December 2019.

See also the right to sign and Suomi.fi authorizations.

Completion of the support application

The support application is filled in in the e-service >

The e-service guides you in filling in the application. Cost support customer service will help if needed, and you can also save your application as a draft and continue filling it out later.

Publicity of cost support applications and decisions

According to Act on the Openness of Government Activities, all documents submitted to the authority will in principle become public once the authority has received them. This also applies to cost support applications. Anyone can get information about applications by request.

However, in addition to the public parts, the application for support may contain confidential information which will not be passed on. If the applicant considers that his or her application contains business or professional secrets (pursuant to section 24 (1) (20) of the Act on the Openness of Government Activities), the applicant may indicate the information he or she considers to be business secrets and the grounds on which the applicant considers it confidential. In this way, the State Treasury knows what matters the applicant considers to be covered by business secrecy. However, the final decision on the extent to which a document must be kept secret rests with the Treasury by law.

All cost support decisions are, in principle, public. If the decision specifies the information that the applicant considers to be business or professional secrets in its application, the decisions may also contain information that is considered to be partially confidential.

Any additional information

If necessary, the State Treasury will request additional information from the applicant. The State Treasury may grant cost support only in accordance with the criteria laid down by law. The company will be able to provide all the information needed on the application form. In addition, the State Treasury automatically receives information from other authorities, such as the Tax Administration, in order to grant support.

Applicants do not, in principle, have to submit additional explanations to the State Treasury, but support applications are processed on the basis of the information provided by the company in its application and received from other authorities.

A company may also authorise another individual to represent the company via the Suomi.fi e-Authorizations service. Select the mandate ‘Application for business funding’.

The customer service of the Digital and Population Data Services Agency is available to assist companies in the use of Suomi.fi mandates.

You can contact us on: +358 295 53 5115

Note. Representative of the association or foundation: if you have any problems with Suomi.fi authorization, please contact the cost support customer service kustannustuki@valtiokonttori.fi

The chairman of the association, who is entered as a chairman in the Finnish Register of Associations, may fill in the application for Cost Support on behalf of the association in e-service. In addition to the application, an association must send evidence via a supplementary information notice that the chairman has the right to sign for association alone or is authorized by the signatories to send the application (association register / rules / minutes / power of attorney).

In the case of foundations, the application should be sent as a paper application if the authorization rights are not already defined.

The cost support phone service is intended for entrepreneurs applying for cost support for companies. At the phone service, we will advise you on filling in the application and answer to your questions.

The cost support phone service serves from 14 December on weekdays from 9.00 to 15.00 at 0295 50 3050.

All calls are recorded.

The State Treasury does not charge additional fees or service charges for calls to 0295 numbers. Operators charge a standard mobile/service network fee for calls.

The second application round for cost support has started and will end on February 26, 2021 at 4.15 pm.

The State Treasury does not charge for calls made to numbers starting with the sequence 0295. Operators will charge standard mobile / local network rates for these calls.

Exchange: +358 295 50 2000

Note! You can change the language from the upper right corner of the secure mail site.

Notifications