The central government’s financial situation remained difficult, and indebtedness continued in 2024. The year’s expenditures exceeded revenues by EUR 12.7 billion.

The State Treasury has submitted its proposal for the 2024 State balance sheet to the Ministry of Finance. The final accounts cover on-budget entities.

The proposed final accounts include:

- the budget realisation statement

- the state income and expense account

- the balance sheet

- the cash flow statement

- the appendices to the statements.

The final central government accounts are attached to the government’s annual report, which is submitted to Parliament in May.

According to the state budget realisation statement, the deficit for the financial year 2024 was EUR 4.1 million Budget income amounted to EUR 86.7 billion. Loans taken out using the budget realisation statement were treated as income.

In 2024, net borrowing totalled EUR 12.1 billion. Budget expenses were EUR 86.7 billion, while the cumulative deficit at the end of the financial year amounted to EUR 5,9 billion.

Expenses increased faster than income

According to the central government’s income and expense account, the deficit for last year was EUR 12.7 billion, while the deficit for 2023 was EUR 7.4 billion. Income increased by 2% and expenses by 9% from 2023. The increase in income was mainly due to the increase in revenues from payment transfers.

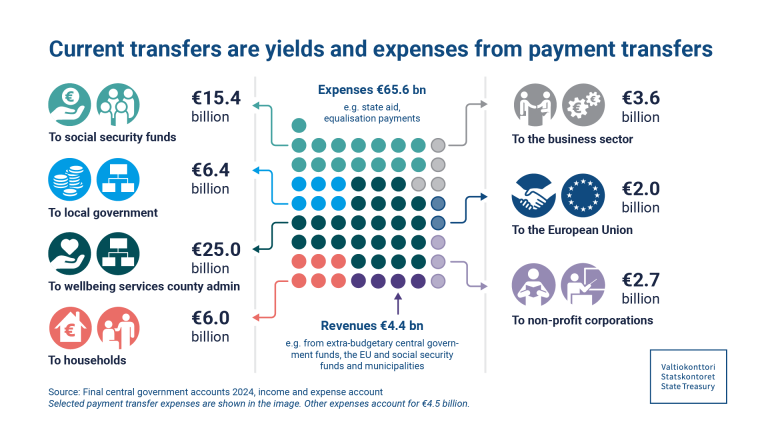

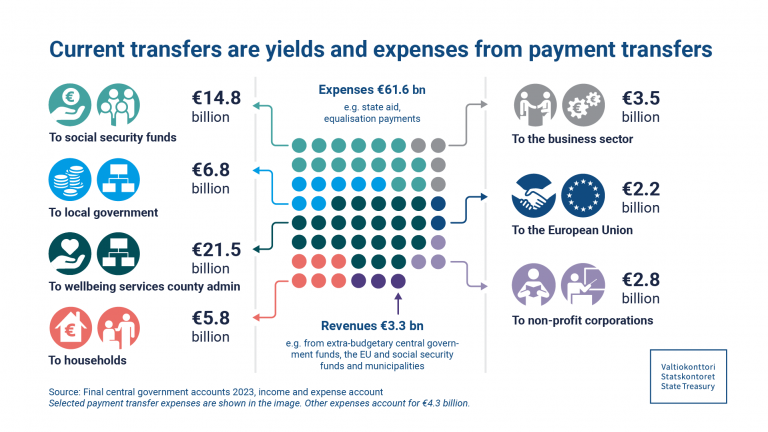

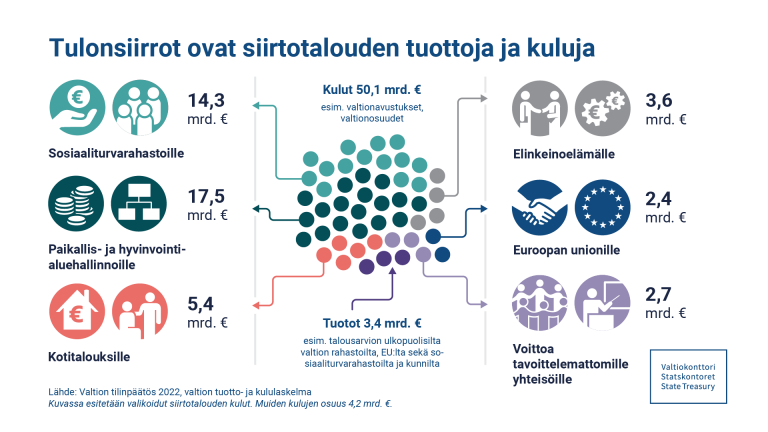

The share of payment transfer expenses in expenses was 78 percent, totalling EUR 65.6 billion, which was approximately EUR 4.0 billion more than in 2023. Payment transfers include revenues and expenses, which do not involve a direct consideration.

The costs of payment transfers to wellbeing services counties amounted to approximately EUR 25.0 billion. In 2023, the corresponding costs totalled EUR 21.5 billion. In addition to wellbeing services counties, EUR 6.4 billion in payment transfer expenses were paid to e.g. other local administration, compared to EUR 6.8 billion in the previous year. In 2024, current transfers to social security funds amounted to EUR 15.4 billion, resulting in an increase of EUR 0.6 billion from the previous year.

The increase in financing costs, which amounted to around EUR 1.0 billion, was primarily the result of rising interest rates. Operating expenses increased by approximately EUR 0.3 billion. This was the result of various factors, such as wage increases and rising prices.

The increase in extraordinary expenses was due to a correction in which Finland’s shares paid to international financial institutions were removed from the central government balance sheet, due to their previously incorrect capitalisation. These total EUR 1.7 billion.*

The central government’s balance sheet decreased by 3.2%

The state balance sheet totalled EUR 71.9 billion, which was approximately 3.2% smaller than in 2023. The biggest changes in the balance sheet were the changes in central government debt, current assets, and securities in fixed assets.

Central government debt according to the balance sheet increased by EUR 12.2 billion to EUR 167.9 billion. Central government debt according to the balance sheet refers to long-term borrowed capital, short-term borrowed capital instalments to be paid in the following financial year, and short-term euro-denominated debts.

The negative equity of on-budget entities was EUR 106.8 billion, representing an increase of EUR 12.7 billion when compared to the previous year. This increase was caused by the deficit.

* Based on the Central Government Accounting Board’s opinion No 25/2003 of 25 August 2003, Record No 1/51/5003, and the Ministry of Finance’s decision VN/24844/2024-VM-1, said items can be considered expenses.

The information on authorizations and their use in the state budget execution calculation at the main title level, as well as the data on authorizations and their use for the administrative area of the 32nd Ministry of Economic Affairs and Employment at moment-level accuracy, have been corrected on 22 April 2025.

The State Treasury’s proposal for the 2024 Final central government accounts > (in Finnish)

Budget realisation, income and expenses and balance sheet >

Also see the visualisations produced for figures in the Final central government accounts >

Further information:

Accounting Manager Jaana Tiimonen, State Treasury, tel. +358 295 502 261, keskuskirjanpito(at)valtiokonttori.fi